The Equity Linked Savings Scheme (ELSS) is a sub-category of equity mutual funds (having investments in the shares and stocks of the companies) that has the major objective of providing tax-saving benefit to the investors under section 80C of the Income Tax Act, 1961. Section 80C of the Act provides a deduction from the total taxable income for an investment made in the specified instruments which include PPF, NSC, ELSS, FD, LIC, etc., for an amount up to Rs.1,50,000 and allows the investors to claim a tax deduction up to Rs.46,350 in a financial year.

Structure of ELSS

As we know that mutual funds are bifurcated into three broad categories, i.e., equity, debt and Hybrid funds, the ELSS is categorised in the equity asset class. This means it has the majority of the funds being invested in the equity and equity-related securities. The portfolio of such funds have high equity exposure, and thus they have investments across various sectors, and market caps, according to which the funds are being diversified. This is the reason the ELSS funds are considered multi-cap funds and the returns offered by them are in the range of moderate to high.

Benefits of ELSS Mutual Funds

1. Dual Advantage

You just not save your taxes with the ELSS investment, it provides you with capital appreciation as well.

- Benefit Of Capital Growth: By allocating the funds in the stocks of diversified companies across different sectors and market capitalisation for a long-term horizon, ELSS tends to offer appreciation in capital. Where stocks and shares of large-cap companies provide income stability, the small- and mid-cap companies with high-growth potential are the best option to attain extremities in the capital during positive market. The fund managers of ELSS have a strategical selection criterion using which they invest the money in different sectors to gain substantial income from theme-based investing.

- Tax Savings : By investing your money in these ELSS funds, you can claim a deduction on your total taxable income in that particular financial year. As ELSS falls in the list of specified instruments of Section 80C, one avails the benefit of reducing one’s taxable income with an amount up to Rs.1,50,000.

2. Tax-Free Returns

Tax-free returns are entirely different from the concept of tax savings under Section 80C. It means that the earnings which are attained in the form of a dividend or capital gain are exempted from tax and are not included in the taxable income of the investors. According to this, you need not pay any amount to the taxman on the earnings from ELSS investments related to returns or capital gain.3. Concept of Lock-In Period

In the case of ELSS investments, the investors’ money is locked for three years, before which they cannot redeem or withdraw the same. In simple words, if you invest in ELSS mutual funds, then your money is locked for a period of complete three years, and you are not allowed to redeem that particular amount until then. Though your money is locked for a particular time span, the returns are notable, and you can’t ignore to earn them. The three years lock-in lets your money grow higher as the fund has investments in the large- and medium-sized companies which have strong potential and fundamentals to enhance your earnings.Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

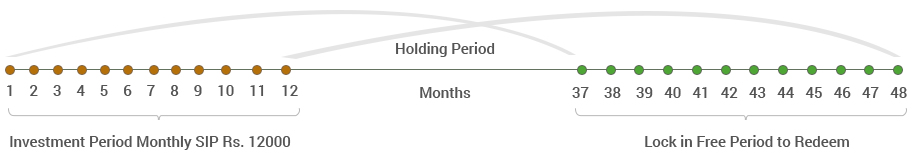

Understanding the Holding Period for Lock-In

The three years lock-in period in the case of mutual funds have a significant influence on the valuation of the investments held in them. Let’s understand the holding period in different cases.Lumpsum: Suppose a lump sum investment is made in ELSS on April 25, 2017, the holding period, i.e., a period of three years will end on April 26, 2020. The money remains locked in for this particular time and attains better opportunity to get multiplied as per market performance.SIP: Suppose one starts a SIP on April 25, 2017, then one can redeem the same amount after completion of three years, i.e., on April 26, 2020. To get a better understanding of the holding period and the amount of redemption after maturity, the following example would be helpful:Example : You start your SIP in January 2017, for a period of one year of a sum of Rs.1000 per month. The day you started investing, the NAV amounted to Rs.10 per unit, according to which, you were allotted 100 units of the scheme in which you made an investment. The lock-in for the SIP started in January 2017 will end after three complete years, i.e., in January 2020. Afterwards, you can redeem the investment value of such 100 units as per the NAV of the redemption date.For every next SIP, the same process is followed, and the funds are redeemed as per the units allotted at the time of purchase after three years of lock-in.

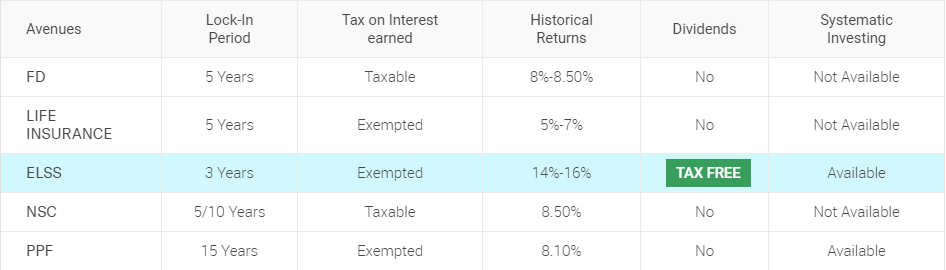

Comparative Analysis of Other Instruments u/s 80C

Section 80C of Income Tax Act, 1961, includes the provisions regarding exemption up to Rs.1,50,000 on the total taxable income. Apart from ELSS, there are several other investments like PPF, LIC, NSC, FD, etc., which provide the same benefit of a tax deduction. But, ELSS is one of the most beneficial instruments which can be proved well in the following presentation.

You can see that the benefits offered by ELSS are greater as compared to other instruments. The amount of investment is eligible for the deduction, and the returns or capital gain in ELSS are exempt from taxes.Apart from the tax saving benefit, the historical returns offered by the ELSS are also commendable as compared to other instruments. Only ELSS is the instrument in all the categories which has offered two-figure returns until now, i.e., in the range of 14%-16%.

Risk & Rewards in ELSS

The risk involved in Equity-Linked Savings Scheme (ELSS) is moderately high due to the majority of the investments in the equity stocks and shares. But the annualised return earned on them are exceptionally higher in the range of 12-15% (annualised). To grab more understanding of the performance of ELSS, you must visit the Performance & Risk Analysis.