As investors, we all go through a learning curve. We get better with experience and learn from our mistakes. But sometimes, we don’t even realize the mistakes we have been making. And because we don’t realize it, we keep bearing the cost of that mistake.

This article delves into the common mistakes people make when investing in mutual funds and provides valuable insights on how to steer clear of them. Avoiding these inadvertent errors is crucial, as they can significantly impact your returns.

So, let’s begin.

1. Chasing Performance

Chasing performance is a mistake most of us have made. After all, it’s really tempting to see a fund give high double-digit returns and invest in it, hoping that its dream run will continue and one will earn those returns.

Unfortunately, in most cases, it doesn’t happen. That’s because top performers change every year.

Take a look at the table below. It shows the top equity funds of the last 10 years.

| Top 3 equity funds on the basis of annual returns | |||

| Year | Fund 1 | Fund 2 | Fund 3 |

| 2013 | ICICI Pru Technology | SBI Technology Opp | Franklin India Technology |

| 2014 | SBI Small Cap | Sundaram Small Cap | UTI Transportation & Logistics |

| 2015 | SBI Healthcare Opp | SBI Small Cap | DSP Small Cap |

| 2016 | DSP Natural Res & New Energy | SBI Magnum Comma | Tata Resources & Energy |

| 2017 | SBI Small Cap | Tata India Consumer | HSBC Small Cap |

| 2018 | Tata Digital India | ICICI Pru Technology | SBI Technology Opp |

| 2019 | ICICI Pru US Bluechip Equity | Nippon India US Equity Opp | 360 ONE Focused Equity |

| 2020 | Union Midcap | DSP Healthcare | Mirae Asset Healthcare |

| 2021 | Quant Small Cap | Quant Infrastructure | HSBC Small Cap |

| 2022 | Aditya Birla SL PSU Equity | SBI PSU | ICICI Pru Infrastructure |

| 2023 | ICICI Pru NASDAQ 100 Index | Nippon India Taiwan Equity | ICICI Pru Nifty Auto Index |

| 2023 data as of June 30, 2023 | |||

As you can see, all sorts of funds have been top performers in the last 10 years.

There are sectoral funds, thematic funds, small-cap funds, international funds and what not.

Now, if you were going to chase performance, you would invest in the year’s top performers, which means a lot of churn in your portfolio.

But is this churning worth it? Let’s look at the numbers

Let’s say, at the start of 2014, you invested Rs 1 lakh each in the top performers of 2013.

On January 1, 2015, you redeemed this money and invested it in the top performers of 2014.

So, every year, you kept investing in the top performer of the previous year by redeeming money from the existing funds at that point in time. You kept doing so until 2023.

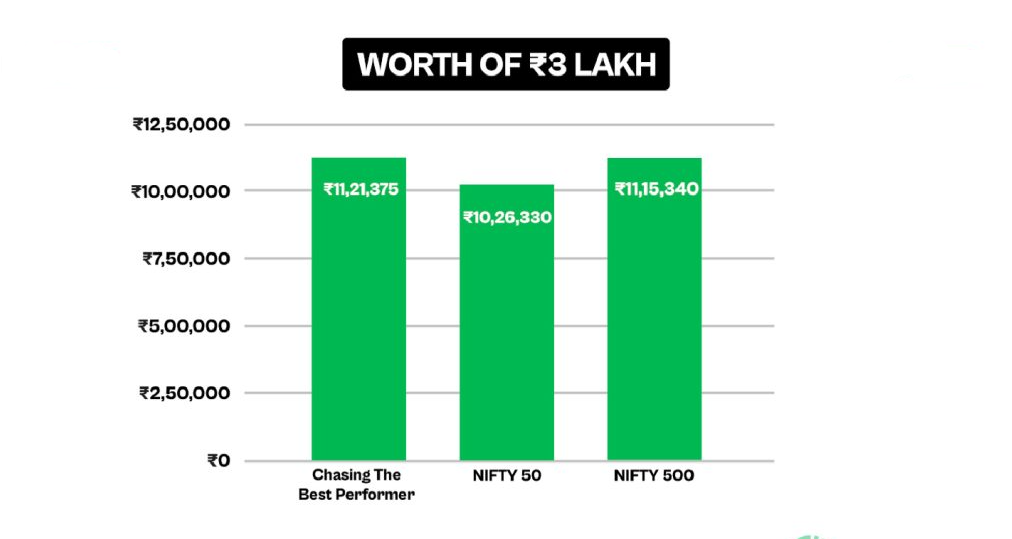

How would your returns compare with someone who invested Rs 3 lakh in the Nifty 50 and Nifty 500 at the start of 2014?

See the chart below. (For simplicity, we have considered pre-tax returns)

So chasing the performance approach doesn’t seem to have delivered massive outperformance. Compared to the Nifty 500, the extra returns are just a few thousand, and that is before taxes.

So, if someone had just invested in NIFTY 500, he would have done well.

That means no buying-selling, tracking the best funds, or tolerating the inherent volatility of thematic/sectoral and small-cap funds.

Let’s talk about the Nifty 50 now.

There is a difference of about Rs 1 lakh compared to the corpus created in Nifty 50, but remember, Nifty 50 is a large-cap index.

On the other hand, the top performers were funds that were supposed to have a higher return potential. And that’s why they appeared on the table you saw earlier.

So, given that, the difference is not big enough.

With the Nifty 50, you would have also experienced less volatility along the way as compared to the other funds.

Not to forget that you would not have been required to do anything during the period. You just invested and stayed there.

It’s like taking 10 different rides to reach your destination faster. But in the end, you realize it possibly was not worth the extra effort. You could have stayed in the same car/train and reached just a few minutes later.

Now, let’s take another scenario.

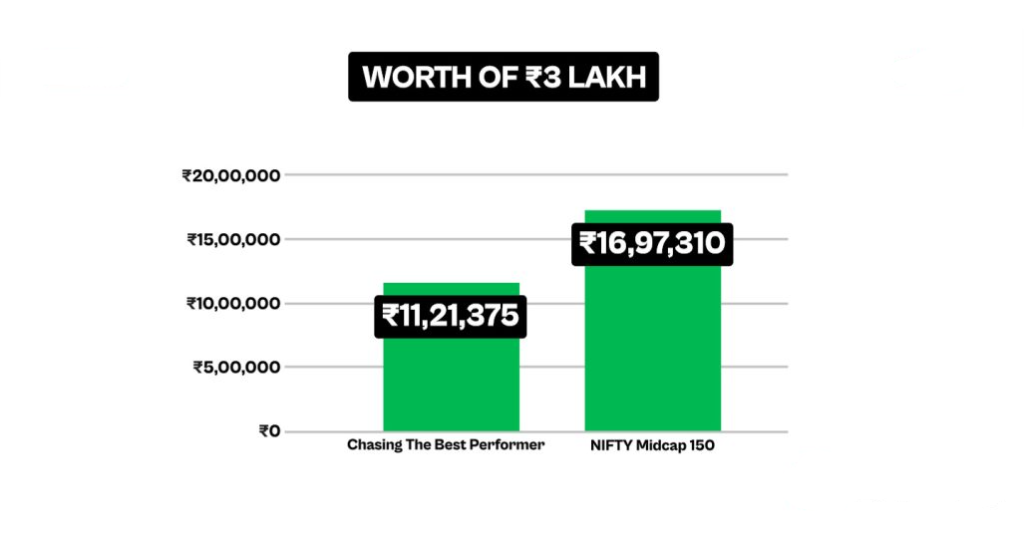

How would the returns compare if, instead of the Nifty 50 and Nifty 500, you had invested in an index with higher return potential but was more volatile?

Refer to the chart below. If we compare the returns from chasing the top performer with the mid-cap index, the difference is huge and in favor of the mid-cap index.

That means if someone is willing to take a higher risk, going with the plain mid-cap index is far more rewarding than chasing the best performer.

Overall, there are better alternatives to performance-chasing as the best performing funds keep on changing.

2. Investing In Sectoral/thematic Funds

From time to time, different sectors and themes do well in the market.

Many investors are attracted to sectoral and thematic funds due to their short-term returns.

However, investing in these funds is riskier than investing in diversified equity funds.

A major challenge of investing in sectoral and thematic funds is guessing which theme will work.

Not many investors can boast of getting that correct. What adds to this problem is that the top sectors or themes keep changing.

If you refer to the table below, it shows the top-performing sectors over the last 10 years.

| Top-performing sectors over the years on the basis of annual returns | ||||

| Sector 1 | Sector 2 | Sector 3 | ||

| 2013 | IT | Pharma | FMCG | |

| 2014 | PSU banking | Banking & Finance | Pharma | |

| 2015 | Media | Pharma | FMCG | |

| 2016 | Metal | Banking & Finance | FMCG | |

| 2017 | Realty | Metal | Banking & Finance | |

| 2018 | IT | FMCG | Banking & Finance | |

| 2019 | Realty | Banking & Finance | Services | |

| 2020 | Pharma | IT | Metal | |

| 2021 | Power | Metal | Utilities | |

| 2022 | Power | Banking | Industrials | |

| 2023 | Defence | Realty | Auto | |

| 2020 data as of June 30, 2023. | ||||

A quick look reveals that the top 3 sectors have changed quite frequently..

So, even if you have identified the right sector, there are slim chances that that sector will remain at the top.

You might say that it doesn’t matter that a sector should remain in the top 3. If it keeps doing well, you can continue to make good returns.

However, in reality, that also may not happen.

The table below is an extension of the table above. The table shows the same list of funds but now with the following 3-year returns. So, for example, if the IT sector did well in 2013, we checked how it performed from 2014 to 2016.

| Top-performing sectors over the years on the basis of annual returns | |||||||

| Sector 1 | Next 3Y returns (% pa) | Sector 2 | Next 3Y returns (% pa) | Sector 3 | Next 3Y returns (% pa) | Next 3Y Nifty 50 returns (% pa) | |

| 2013 | IT | 5.12 | Pharma | 10.79 | FMCG | 8.20 | 10.42 |

| 2014 | PSU banking | -4.10 | Banking & finance | 12.79 | Pharma | -3.67 | 9.32 |

| 2015 | Media | -0.06 | Pharma | -9.00 | FMCG | 16.37 | 12.55 |

| 2016 | Metal | 4.94 | Banking & finance | 26.13 | FMCG | 14.93 | 15.66 |

| 2017 | Realty | -2.57 | Metal | -3.67 | Banking & finance | 14.09 | 11.73 |

| 2018 | IT | 41.72 | FMCG | 9.01 | Banking & finance | 14.50 | 18.12 |

| 2019 | Realty | 13.60 | Banking & finance | 9.82 | Services | 13.60 | 15.49 |

| 2020 | Pharma | 3.06 | IT | 9.96 | Metal | 32.21 | 14.81 |

| Data for the corresponding Nifty indices. 2020 data as of June 30, 2023. | |||||||

If we compare these returns with that of Nifty 50, in over 70% of cases, the top sectors underperformed the Nifty 50 in the next 3 years.

This suggests that not just the sectors change but the good-performing sectors in a year are often unable to keep up the pace.

Now, lets see the top thematic funds and their themes over the years from the table below.

| Top-performing thematic funds over the years | ||||||

| Fund 1 | Theme | Fund 2 | Theme | Fund 3 | Theme | |

| 2013 | ICICI Pru US Bluechip Equity | Global | Aditya Birla SL Intl. Equity -A | Global | Tata Ethical | Others/ESG |

| 2014 | Aditya Birla SL MNC | MNC | SBI Magnum Global | MNC | UTI MNC | MNC |

| 2015 | Aditya Birla SL MNC | MNC | UTI MNC | MNC | Nippon India Japan Equity | Global |

| 2016 | SBI Magnum Comma | Consumption | Sundaram Consumption | Consumption | Invesco India PSU Equity | PSU |

| 2017 | Tata India Consumer | Consumption | SBI Consumption Opp | Consumption | Mirae Asset Great Consumer | Consumption |

| 2018 | Baroda BNP Paribas India Consumption | Consumption | Nippon India US Equity Opp | Global | ICICI Pru FMCG | Consumption |

| 2019 | ICICI Pru US Bluechip Equity | Global | Nippon India US Equity Opp | Global | Franklin Asian Equity | Global |

| 2020 | ICICI Pru ESG | ESG | Axis ESG Equity | ESG | Kotak Pioneer | Others |

| 2021 | ICICI Pru Commodities | Consumption | Quant ESG Equity | ESG | Edelweiss Recently Listed IPO | Others |

| 2022 | Aditya Birla SL PSU Equity | PSU | SBI PSU | PSU | Quant Quantamental | Quant |

| 2023 | ICICI Pru NASDAQ 100 Index | Global | Nippon India Taiwan Equity | Global | ICICI Pru US Bluechip Equity | Global |

| 2023 data as of June 30, 2023 | ||||||

Here also a similar picture emerges. The top funds change, so different themes have performed well in different periods.

Another challenge with thematic funds is that funds following the same theme can give very different returns, depending on how the fund manager picks stocks.

Take a look at the table on your screen. It shows the returns of various consumption funds in 2022.

The consumption theme has the largest number of funds in the thematic category.

| Returns of consumption funds in 2022 | ||||

| Fund | 2022 return (%) | |||

| Nippon India Consumption Fund | 15.71 | |||

| SBI Consumption Opportunities Fund | 15.06 | |||

| ICICI Prudential Bharat Consumption Fund | 10.98 | |||

| Sundaram Consumption Fund | 10.39 | |||

| Mahindra Manulife Consumption Fund | 9.53 | |||

| Mirae Asset Great Consumer Fund | 8.89 | |||

| ICICI Prudential Nifty India Consumption ETF | 8.30 | |||

| Nippon India ETF Nifty India Consumption | 8.16 | |||

| Axis NIFTY India Consumption ETF | 8.11 | |||

| SBI Nifty Consumption ETF | 8.09 | |||

| Canara Robeco Consumer Trends Fund | 7.60 | |||

| Aditya Birla Sun Life India GenNext Fund | 6.34 | |||

| Baroda BNP Paribas India Consumption Fund | 6.31 | |||

| Tata India Consumer Fund | 2.38 | |||

| UTI India Consumer Fund | -1.67 | |||

As you can see, the returns range from about 16% to – 2%. And this trend is not limited only to this thematic category.

So, even if you have spotted the right theme, you can’t be sure that the chosen fund will outperform.

So, what should you do?

Taking calls on specific sectors or themes is not your job as a mutual fund investor. That’s what your fund manager should do.

So, if a sector or a theme is up-and-coming, it will also find a place in a diversified equity fund, as your fund manager will pick stocks from it.

You don’t have to do it yourself. If you do it yourself, you will probably just increase your risk.

Now let’s talk about the next mistake: going overboard on mid- and small-cap funds

3. Investing heavily in mid- and small-cap funds

Like sectoral and thematic funds, mid- and small-cap funds attract a lot of attention.

In bull runs, these funds tend to give amazing returns, and many investors find that too difficult to ignore.

So, it’s obvious that people would want to invest in mid-cap and small-cap funds.

But these funds are not meant for everyone.

Only if you are willing to take higher risk for better returns should you invest in mid- and small-cap funds.

If you are someone who doesn’t like too many ups and downs in your portfolio, you can very well remain with diversified equity funds.

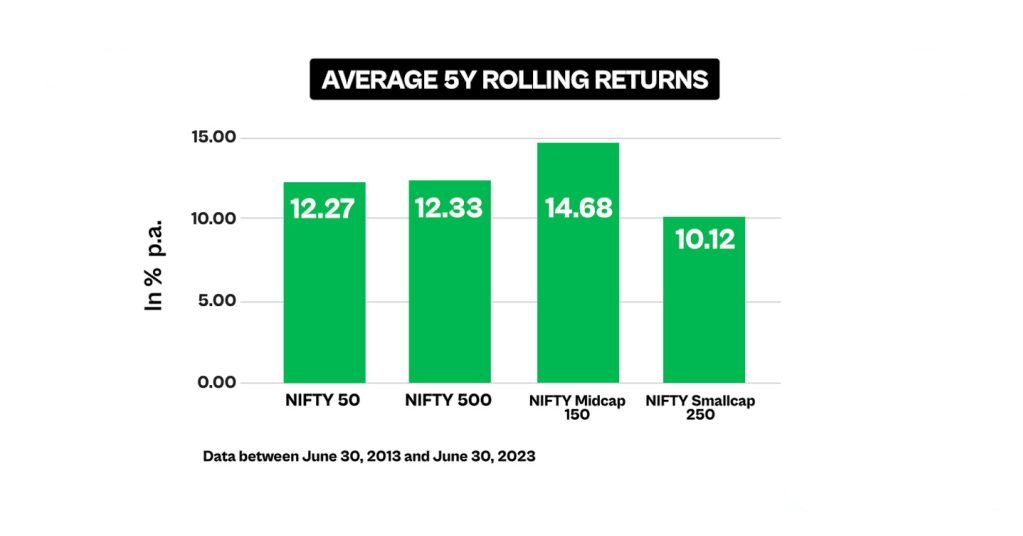

To better understand this risk-return equation, let’s look at the 5-year rolling returns from 2013 of Nifty 50, Nifty 500, Nifty Mid cap 150, and Nifty Small cap 250

Now, the mid-cap index has delivered the best performance. Nifty 50 and Nifty 500 have done a decent job, while the small-cap index has failed to impress.

But one should not see returns alone. Returns should be seen in conjunction with the ensuing volatility.

If you had to tolerate more ups and downs to get one to two percentage points extra, perhaps the extra returns are not as appealing.

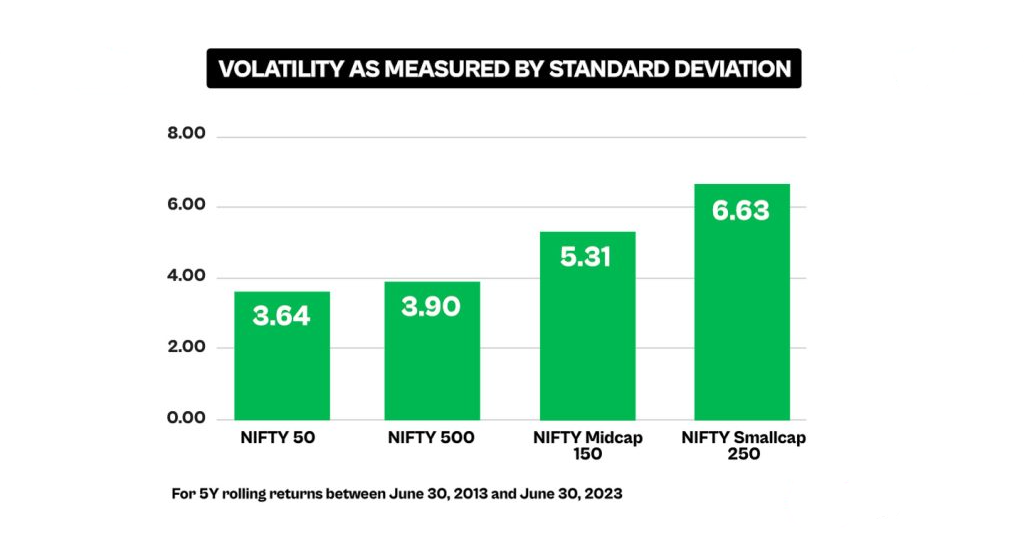

So how volatile are all the indices we mentioned above? For this, we looked at their standard deviation. The higher the standard deviation, the more volatility.

As you might have guessed, mid- and small caps are quite volatile. Notably, the small-cap index has proved to be the most volatile and hasn’t delivered either.

Hence, invest in the mid-and small-cap categories, especially the small-cap ones, only after much thought. A large allocation to mid- and small-cap funds in your portfolio can make it swing wildly with market winds.

If you do decide to invest in them, avoid not putting more than 30% of the worth of your portfolio in them.

Let’s now talk about the next mistake: not reviewing your portfolio.

4. Not reviewing your portfolio

Yet another common mistake that investors make is that they don’t review their portfolio periodically.

This is essential. It helps you to cut down on risks and problems. And this can help you boost your returns.

Let me give you one example from my portfolio. In 2014, I started investing in a tax saving fund. (Aditya Birla SL ELSS Tax Relief 96) It was doing quite well at that time. For three years, the fund outperformed NIFTY 50 and NIFTY 500.

But from 2018 onwards, it started slipping. It has underperformed the benchmark since then. I waited for four years of continuous underperformance to stop my SIPs. So, finally, I stopped investing in it in 2022. I will be able to withdraw from it entirely by 2025. Until then, I am stuck with it.

If I had reviewed my portfolio regularly, I could have stopped my SIPs earlier in 2020 or 2021 after two to three years of underperformance. And I could have possibly exited the fund entirely this year. My portfolio returns would have been slightly better.

But portfolio review is not only about looking at underperforming funds. For example, you check for exposure to different asset classes when reviewing your portfolio. You see, if you have too many funds in the same category. You can even go much deeper to see if your funds complement each other and whether the fund strategy has changed over the years.

Over the years, I have realized that there’s nothing as a perfect or a hopeless portfolio. There are only optimized and unoptimized portfolios. And the difference between the two could be significant.

Let’s now see how not reviewing your portfolio can compromise the quality of your portfolio.

We all know that the top funds keep changing every few years. A fund giving you high returns for the past three-four years can suddenly start underperforming. And it can continue to do so for years to come.

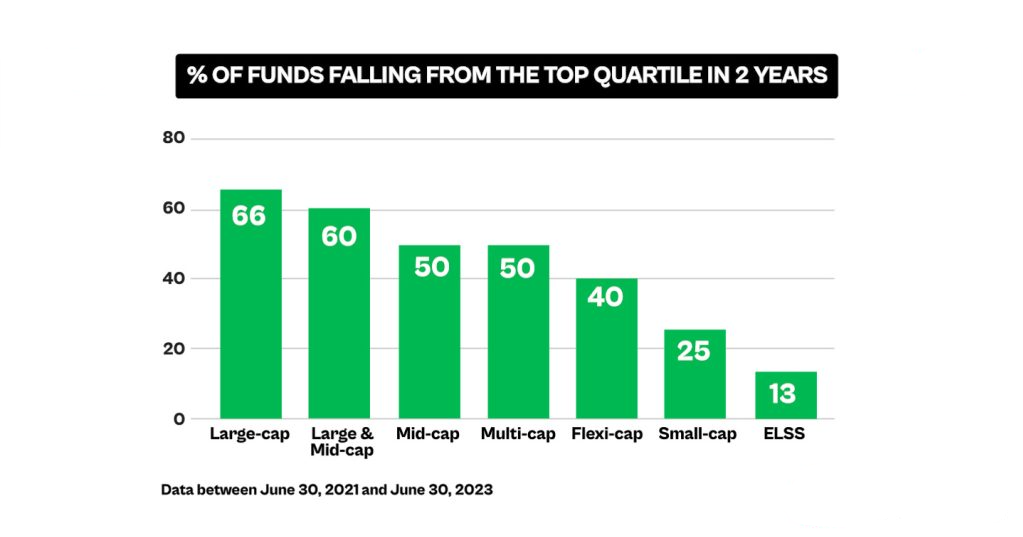

See the chart on your screen.

This chart could be a bit technical. It shows the percent of funds across categories that have fallen from the top quartile, or the top 25% in terms of returns, over the last two years.

To put it simply, it shows how the top-performing funds change every two years. For example, in the large-cap category, most top funds change every two years. On the other hand, in the ELSS category, the top-performing funds don’t change as often in two years.

So, even if you have picked good funds, you should regularly monitor your portfolio.

Of course, a slight deterioration in the fund’s performance over the short term is no cause for concern. However, if a fund continues to underperform for two years or more, you should consider exiting it.

You can find tools available on Regnum Digital app to help you with this. The Fund Report Card can help to understand whether the fund is worth investing. Then there is a Portfolio Health Check which gives a thorough portfolio analysis, which can be a good starting point.

Let’s now move to the next point: not starting with a financial plan.

5. Not starting with a financial plan

Many of us start investing right away without first giving a thought to what we want to achieve with our investments.

That is to say, we don’t have a financial plan in place.

Just think of this: what do you do when you are going on a vacation?

You first decide on a destination and then the budget. Following this, you book tickets and stay and look for places of interest that you would go to.

I don’t think any of us step out of the house without knowing the destination. We don’t pack our bags, then go to the airport and then start looking for tickets to some place where we can spend time holidaying.

Same is with financial planning.

Without a financial plan, investing is like shooting arrows in the dark.

Even if you do your SIPs diligently and have a long-term focus, you won’t know how much to save for which goal without a financial plan.

You won’t know whether your SIP amount is enough, if you need to increase it, and by how much.

Another issue is that you won’t have an exit plan, which can delay your goals. That’s because markets don’t know which year you need the money for the purpose you are saving. They will crash at their whim.

Let me explain with an example. Suppose you started investing in 2010 in equities, and then in November 2019, you decided to buy a house. By the time you finalized a house, it was March. But markets crashed due to COVID-19. And since your entire money was in equity, a large chunk of your gains would have been wiped away, forcing you to delay buying a house till your investments recover.

So, to avoid such negative surprises at a time when you can afford them the least, it’s better to have a financial plan in place.

Financial planning has other hidden benefits:

- It provides a sense of direction and purpose.

- It keeps you on track.

- It provides measurable steps. And what gets measured gets done.

- It helps you stay focused and motivated.

Interestingly, a financial plan doesn’t start with investing.

It starts with building a sufficient emergency fund, which should be equal to 6 to 12 months of your expenses.

Then come health insurance and life insurance. Adequate insurance acts as a shield against life’s uncertainties.

Then comes investing.

How much you need to invest will depend on how much you want to accumulate and what the rate of return and inflation are.

It’s important to get these numbers right if you want to create a robust financial plan for yourself.

Let’s now talk about other mistakes that you should avoid while investing in mutual funds.

6. Other mutual fund mistakes

So, above, we have covered the key mistakes that investors make while investing in mutual funds.

However, there are some others too, and you may already be aware of a few of them. Yet it’s worth revisiting them.

a. Investing in regular plans

Regular plans entail distributor commission, and because of this, the fund house has to incur higher expenses. These higher expenses translate into a higher cost you have to pay, which ultimately leads to lower returns

On the other hand, direct plans don’t have commissions involved and so investing in them is more rewarding than its regular plan.

See the table on your screen. It mentions the difference between the returns of direct and regular plans across categories. And how investing in direct plans can boost your final corpus

| Regular vs direct plans: 10Y category average returns & worth of Rs 1 lakh in 10 years | |||||

| Return – direct plan (% pa) | Worth of Rs 1 lakh (Rs) | Return – regular plan (% pa) | Worth of Rs 1 lakh (Rs) | Difference in corpus (Rs) | |

| Small-cap | 22.58 | 7,66,029 | 21.36 | 6,92,882 | 73,148 |

| Mid-cap | 20.69 | 6,55,715 | 19.50 | 5,93,793 | 61,922 |

| Large & mid-cap | 17.62 | 5,06,705 | 16.38 | 4,55,778 | 50,927 |

| Multi-cap | 18.41 | 5,41,701 | 17.42 | 4,98,411 | 43,291 |

| Large-cap | 14.83 | 3,98,571 | 13.70 | 3,61,042 | 37,529 |

| Flexi-cap | 16.60 | 4,64,669 | 15.74 | 4,31,371 | 33,298 |

The next point is investing in the IDCW option.

b. Investing in the IDCW option

Formerly called the ‘dividend’ option, IDCW stands for ‘income distribution cum capital withdrawal’. It is an option that AMCs provide if you need payouts from your funds.

SEBI changed the names of these plans as their payouts aren’t really dividends. What you get is part of your capital and part of your returns back. Hence, the name IDCW.

Should you invest in this option? Well, no. The growth option is better as it helps in better compounding of capital.

Plus, the payouts from IDCW are irregular and may be insufficient. They are completely at the AMCs’ discretion.

IDCW payouts are also taxed at your applicable slab. So, if you are in the highest tax slab, more than a third of the payout will be gone in tax.

The next point is investing in NFOs.

c. Investing in NFOs

In a new fund offer or an NFO, a fund house raises money from investors for a new fund.

NFOs tend to have a low net asset value or NAV, such as Rs 10. Some investors mistakenly believe that a low NAV means a cheap fund, and it will lead to better returns.

First, one should avoid investing in NFOs as these funds don’t have a history. It’s always better to go with a fund that has proved its worth across market phases.

Second, don’t think that a low NAV means a cheap fund. NAV itself doesn’t make a fund cheap or expensive.

Neither should you compare a low NAV with a high NAV of another fund and think there is kan ample scope for the NAV to grow.

The NAVs of the two funds are not comparable.

It’s not the NAV but the change in NAV that contributes to your returns.

Let’s now quickly talk about the next mistake: investing your short-term money in equity.

d.Investing short-term money in equity

When the markets are in a bull phase, many investors want to ride the wave.

Some investors also see the historical short-term returns of funds and get carried away by their one-year or three-year returns.

Remembering that past performance doesn’t guarantee future returns is worthwhile.

Also, one should see the worst performance of a fund over one-year, three-year or such periods to get an idea about what they can lose.

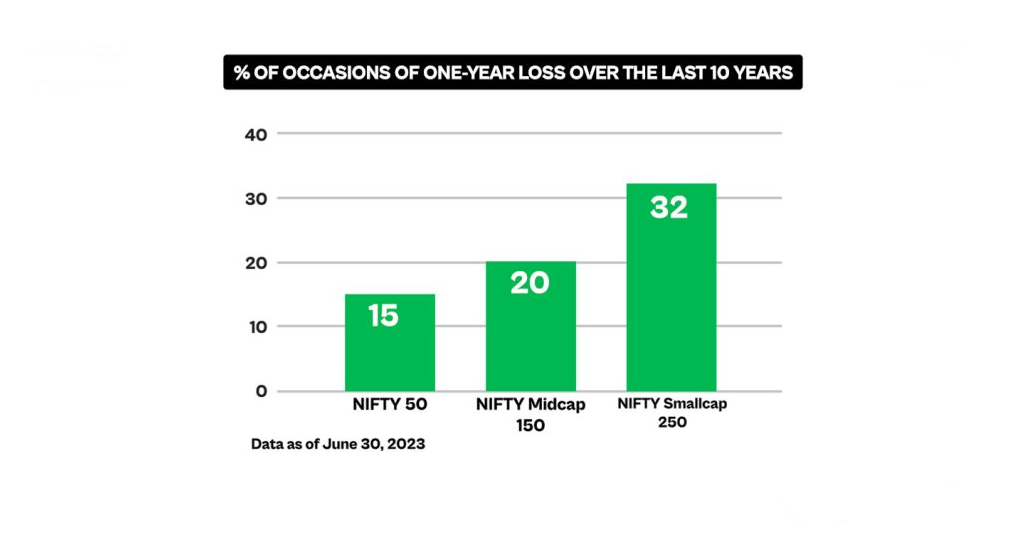

See the chart below. It shows how many times various indices made a loss over a one-year period.

While Nifty 50’s numbers still look respectable, mid-and small-caps exhibit a higher chance of giving you a loss in the short term.

With small caps, it’s almost one-third probability.

So, never invest in equity for the short term. Keep at least a five-year horizon. It’s better to keep a seven-year horizon for riskier categories like mid-cap and small-cap.

Keeping this horizon will ensure a good return experience from equity.

If you are able to avoid the above mistakes, you improve the probability of you doing good in the markets improves significantly.

To help you in your journey, we have a comprehensive portfolio health check-up available on our app. The best part? It’s Free. With this portfolio analysis, you can ensure that your investments are optimized and avoid being stuck with underperforming funds.

So, what are you waiting for? Download the Regnum Digital today and pave the way for a prosperous tomorrow.